By Joke Kujenya

A TOTAL of N1.143 trillion in May 2024 Federation Accounts Revenue has been distributed among the Federal Government, States, and Local Government Councils.

The allocation was made during the June 2024 meeting of the Federation Accounts Allocation Committee (FAAC), chaired by Finance Minister Wale Edun.

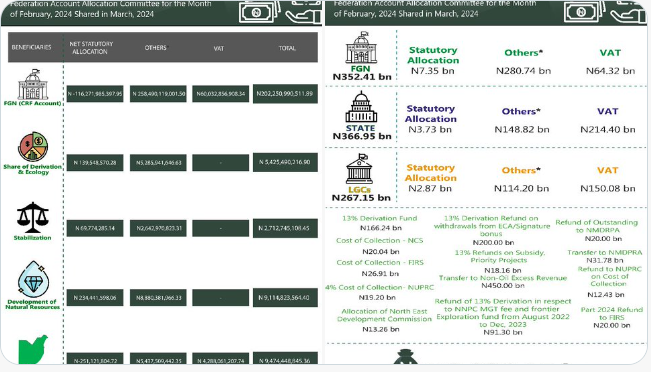

The FAAC communiqué issued on this development detailed the composition of the total distributable revenue: N157.183 billion from statutory revenue, N463.425 billion from Value Added Tax (VAT), N15.146 billion from the Electronic Money Transfer Levy (EMTL), and N507.456 billion from Exchange Difference revenue.

Gross statutory revenue for May stood at N1.223 trillion, a slight decrease from April’s N1.233 trillion. Similarly, VAT revenue for May was N497.665 billion, down from N500.920 billion in April.

From the total distributable revenue of N1.143 trillion, the Federal Government received N365.813 billion, States received N388.419 billion, and Local Government Councils received N282.476 billion.

Additionally, N106.502 billion was allocated to the States as derivation revenue, which represents 13% of mineral revenue.

The communiqué also provided a breakdown of the N157.183 billion distributable statutory revenue: the Federal Government received N61.010 billion, State Governments received N30.945 billion, and Local Government Councils received N23.857 billion.

Another N41.371 billion was allocated to the States as derivation revenue.

From the N463.425 billion VAT revenue, the Federal Government received N69.514 billion, State Governments received N231.713 billion, and Local Government Councils received N162.199 billion.

The N15.146 billion EMTL revenue was distributed with the Federal Government receiving N2.272 billion, State Governments N7.573 billion, and Local Government Councils N5.301 billion.

The N507.456 billion Exchange Difference revenue was divided with the Federal Government receiving N233.017 billion, State Governments N118.189 billion, and Local Government Councils N91.119 billion.

An additional N65.131 billion was shared as derivation revenue to the

The communiqué also noted significant increases in Companies Income Tax (CIT) and Petroleum Profit Tax (PPT) for May, while Import and Excise Duties, Royalty Crude and Gas, EMTL, CET Levies, and VAT recorded decreases.

The balance in the Excess Crude Account (ECA) stood at $473,754.57, according to the account shared by Bayo Onanuga, Special Adviser on Information and Strategy to President Tinubu, on his X handle.

The statement was signed by Bawa Mokwa, Director of Press and Public Relations, Office of the Accountant General of the Federation.

At JKNewsMedia, our dedication to delivering reliable news and insightful information to our cherished readers remains unwavering. Every day, we strive to provide you with top-notch content that informs and enlightens. By donating to JKNewsMedia, you directly contribute to our mission of delivering quality journalism that empowers and informs. Your support fuels our commitment to bringing you the latest updates and in-depth analysis. Let's continue to uphold the highest standards of journalism and serve our community with integrity and dedication. Thank you for being a part of the JKNewsMedia family and for your ongoing support.