By Jemimah Wellington, JKNewsMedia Reporter

THE FEDERAL Executive Council (FEC) has approved new external borrowing of $2.2 billion to bolster Nigeria’s finances and support the nation’s economic reform agenda.

This funding includes $1.7 billion allocated for Eurobond issuance and an additional $500 million in Sukuk financing.

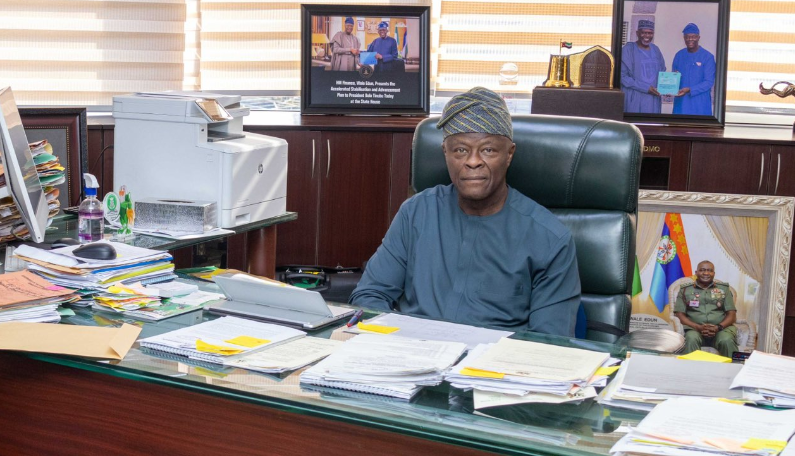

Announced by Finance Minister and Coordinating Minister of the Economy, Wale Edun, this decision followed Thursday’s FEC meeting, presided over by President Bola Tinubu at the State House.

Edun explained that the external borrowing approval is a strategic move, pending final authorization from the National Assembly, which will enable Nigeria to tap into the international capital markets.

“The $2.2 billion programme will allow Nigeria to issue a mix of Eurobonds and Sukuk, pending legislative approval,” he said.

The loan is anticipated to increase Nigeria’s access to international financing and strengthen support for Tinubu’s macroeconomic policies, focused on market pricing reforms for fuel and foreign exchange.

Highlighting the resilience of Nigeria’s financial markets, Edun pointed to Nigeria’s ability to attract local investors to domestic dollar bonds, demonstrating financial stability.

Access to international capital, he noted, is further proof of confidence in Tinubu’s economic recovery program.

In addition to the external borrowing, the FEC approved the establishment of a N250 billion real estate investment fund aimed at reducing Nigeria’s severe housing deficit, estimated at 22 million units.

Edun stated that the fund, overseen by the Ministry of Finance Incorporated (MOFI), would provide affordable, long-term mortgages for Nigerians.

“The MOFI Real Estate Investment Fund will allow Nigerians to access mortgages at significantly lower rates than the 30% market rate, with terms extending up to 20 years,” Edun explained.

He adds that the real estate fund will not only address the housing shortage but also stimulate job creation and economic growth by encouraging private-sector investment in housing.

He also said that the initial funding of N250 billion includes a blend of N150 billion in seed funding, which aims to attract further investments, offering competitive returns to investors while helping to alleviate the housing crisis.