By Joke Kujenya

HIGHER OIL and non-oil tax collections boosted Nigeria’s federally collected revenue to ₦2.41 trillion in November 2024, reflecting a 21.23% increase from the previous month.

Despite the rise, earnings still fell 19.65% short of the monthly target, underscoring persistent fiscal challenges, according to the Central Bank of Nigeria (CBN) economic report released on Friday.

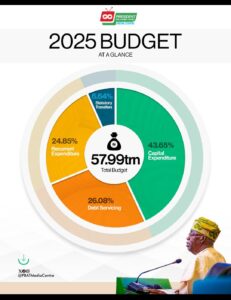

A detailed breakdown of the newly approved budget by the National Assembly, expected to be transmitted to President Bola Tinubu soon, highlights major improvements in fiscal management.

It shows capital expenditure is prioritised at ₦23.9 trillion, accounting for 43.65%—the highest in Nigeria’s history. Debt servicing now takes up 26% of the budget, reflecting improved debt management, while recurrent spending stands at ₦13.64 trillion (24.85%), and statutory transfers amount to ₦3.645 trillion (6.64%).

Revenue growth stemmed from increased collections in petroleum profit tax (PPT), royalties, company income tax (CIT) from upstream operations, customs duties, and corporate tax.

Oil revenue alone surged 42.63% to ₦0.52 trillion, supported by higher PPT and royalty payments, but remained 70.46% below projections due to ongoing production constraints and inefficiencies.

Federal government is said to have retained earnings reached ₦0.82 trillion, still 49.92% below target, highlighting continued fiscal shortfalls.

Meanwhile, the fiscal deficit shrank by 15% compared to October yet remained 18.72% above target as government spending declined.

Total federal expenditure dropped 5.8% month-on-month to ₦1.73 trillion, with capital outlays plunging 46.01%, leaving recurrent spending at 77% of total expenditure.

Revenue distribution among Nigeria’s three tiers of government resulted in a net allocation of ₦1.41 trillion after deductions and transfers.

The federal government noted it received ₦0.43 trillion, states got ₦0.49 trillion, and local governments were allocated ₦0.36 trillion, while oil-producing states shared ₦0.13 trillion under the 13% derivation fund.

However, total disbursements remained 38.87% below target.

Also, the CBN’s latest data highlights Nigeria’s ongoing struggle to meet revenue expectations despite improved tax collections, noting that a sharp decline in capital spending could impact infrastructure projects, while persistent fiscal deficits may drive further government borrowing and monetary policy adjustments to stabilise the economy.