By Jemimah Wellington, JKNMedia Reporter

IN THE FIRST quarter of 2024, Nigeria witnessed a significant surge in capital importation, totaling US$3,376.01 million, according to the latest report gotten from the National Bureau of Statistics (NBS) on its X handle.

This marks a substantial increase of 198.06% compared to the US$1,132.65 million recorded in the first quarter of 2023.

Furthermore, the NBS notes an impressive quarter-on-quarter growth of 210.16%, up from US$1,088.48 million in Q4 2023.

Key insights from the report include:

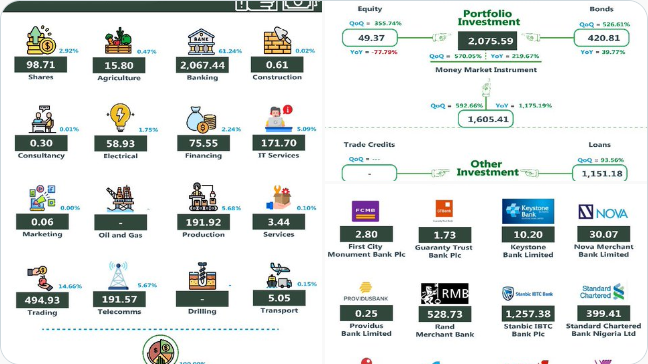

Investment Type: Portfolio Investment led the way, totaling US$2,075.59 million and representing 61.48% of the total capital importation. Other Investments followed at US$1,181.25 million (34.99%), while Foreign Direct Investment (FDI) contributed the least with US$119.18 million, making up 3.53%.

Sector Analysis: The Banking sector attracted the highest capital inflow with US$2,067.44 million, accounting for 61.24% of the total. The Trading sector came next with US$494.93 million (14.66%), and the Production/Manufacturing sector followed with US$191.92 million (5.68%).

Source Countries: The United Kingdom was the largest source of capital importation, contributing US$1,805.83 million (53.49%). The Republic of South Africa and the Cayman Islands followed with US$582.34 million (17.25%) and US$186.21 million (5.52%), respectively.

Destination States: Lagos State remained the top destination for capital importation, receiving US$2,782.41 million (82.42%). Abuja (FCT) followed with US$593.58 million (17.58%), while Ekiti State recorded a minimal inflow of US$0.01 million.

Top Banks: Stanbic IBTC Bank Plc emerged as the leading bank, receiving US$1,257.38 million (37.24%). Citibank Nigeria Limited and Rand Merchant Bank Plc followed with US$547.71 million (16.22%) and US$528.73 million (15.66%), respectively.

This substantial increase in capital importation underscores Nigeria’s growing attractiveness to foreign investors and the robust performance of its financial and trading sectors.